What’s happening in HR tech? Insights you need

- HRM Asia Newsroom

This year’s HR Systems Survey, now in its 27th year, revealed a treasure trove of information about the HR tech landscape, as well as about HR teams around the globe. Thanks to our growing research community, we had our highest level of responses yet. This year’s survey data represents 3,318 unique organisations from 59 countries.

The survey covers 14 different categories of HR systems, yielding more than 1,000 data points, so it would be impossible to share everything we have learned here. Therefore, I will stick with three significant findings.

HRMS churn is coming

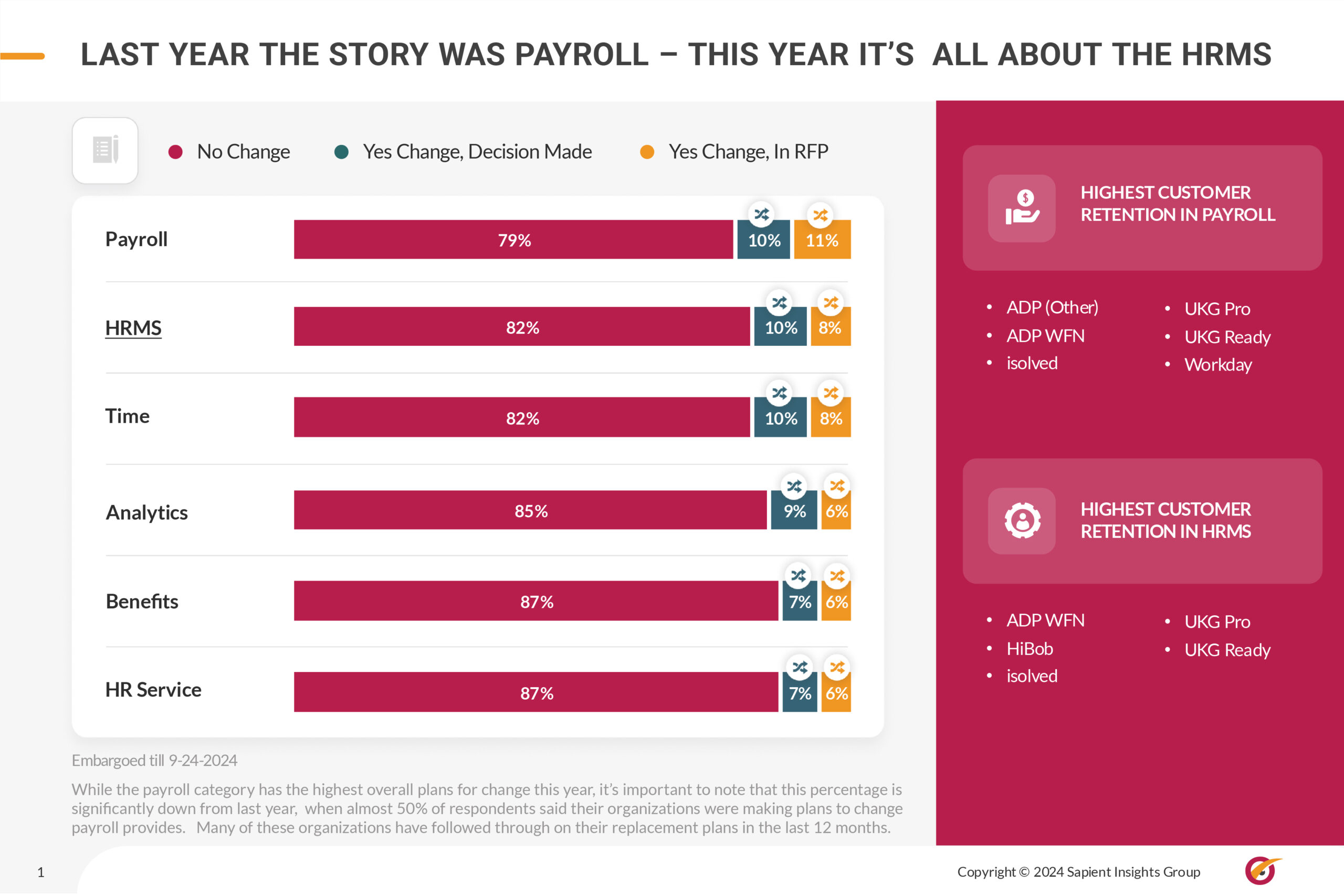

We have been tracking system replacement plans for many years. The data collected offers insights into where future investments will be made, which systems are ripe for replacement, and which vendors could stand to gain (or lose) from system changes.

This year, 10% of all survey respondents said their organisations had made the decision to replace their HRMS; 8% had active RFPs. At the enterprise level (organisations with over 5,000 employees), a full 28% of respondents said they were planning to replace their HRMS in the next 12 months or had RFPs in process – more than double from last year when only 10% of enterprise respondents had HRMS replacement plans.

In my mind, there are several reasons behind the increasing replacement plans. The first is that it is now easier to make such big changes. Most solutions are now cloud-based and there are fewer major functionality differences between solutions. As solutions become more comparable in functionality, factors such as vendor satisfaction, user experience, and global capabilities become more important. While such as HRMS change is still painful, organisations are no longer held hostage to solutions that they have outgrown or that provide less-than-optimal service.

Another factor playing into the churn is that vendors are “jumping” markets. By that, I mean that vendors that formerly served organisations of certain sizes or industry segments are now marketing to broader audiences. This is happening up and down the HRMS market. For instance, isolved and HiBob, organisations that historically have been the greatest success with smaller businesses, are now appearing in RFPs for larger organisations. Workday, long recognised as the leader for enterprise HRMS, is now showing up in mid-market RFPs.

We do advise organisations planning to make significant tech changes to do their detective work. Do not just look at vendor satisfaction or user experience scores for this year; also look at the historical data. Carefully examine financials and ask about merger or acquisition plans or growth strategies (market consolidation is far from over). Ensure advertised partnerships offer real value through pre-built integrations or co-solutioning processes and are not just marketing hype.

A move towards platform clusters

Another trend we are observing is a move towards building an HR tech ecosystem around two or three pillars – critical applications for major functional areas – rather than relying on a single suite or a multitude of best-of-breed solutions. For instance, an organisation may use its HRMS, learning solution, and payroll system as its primary three platform pillars, chosen based on factors such as price, global and industry support, and essential functionality, but also based on the vendors’ proven partners.

Vendor partnerships that offer additional functionality plus streamlined, hassle-free, and deep integration with platform pillars can reduce internal development resources and minimise ownership headaches.

READ MORE: 2025 predictions for HR leaders and their tech tools from HR Tech

While I do not see this approach as an overnight change, it is a practical alternative to relying primarily on a single vendor or managing a portfolio of best-of-breed solutions. I do believe it is also factoring into some organisations’ replacement plans. It is a trend worth watching and potentially something to consider as you think about taking your HR tech strategy into the future.

Who’s in charge of HR systems?

We have been tracking the role of HR tech professionals for several years now. We have long held that HR tech requires specialised expertise. The average organisation now has 22 different HR-related systems, and HR tech ecosystems are expanding day by day.

Specialisation is also warranted because HR-related systems touch employees in very significant ways. Ease of use and access, security, privacy, and support are all hugely important. The people managing these applications need to be very familiar with the data that is being handled, how employees use the technology, regional regulations, and all of the critical integration points.

This year’s survey found that 43% of respondents said their organisations had a defined HR tech function. Yet, our survey showed that 58% of those with HR tech roles have less than three years of experience in their jobs. This percentage has been steadily creeping up since we first started tracking it in 2020. We also found that training for the job is scattershot, with the largest percentage relying on training and resources from solution providers.

On a related note, this year’s survey also showed that ownership of the HR tech budget is still up for grabs. For instance, in 33% of enterprise organisations, the IT function owns the HR tech budget. In 28% of small organisations, the HR tech budget is owned by finance or another executive function. Besides being an issue of control, ownership of the HR tech budget is directly correlated to HR’s perception throughout the organisation. When HR owns and leads HR tech, it is 38% more likely to be perceived as strategic, rather than compliance focused.

My advice? Advocate to make HR tech a specialised function on your team, if it is not already. And make sure those in charge of these important systems get the training and skills support they need to optimise your organisation’s HR tech investments and build an HR systems strategy.

In the upcoming months, I look forward to sharing data specific to the Asia-Pacific region. Meanwhile, click here to see this year’s Voice of the Customer ranking for vendor satisfaction and user experience. Also, click here for more details about the 2024-2025 HR Systems Survey Report.

About the Author: