Tax rates in South East Asia: Philippines has highest tax

- Daniel Teo

- Topics: Home Page - News, Indonesia, Malaysia, News, Philippines, Singapore, Southeast Asia, Thailand, Vietnam

Do you and your company know how much tax you are paying? Tax can be a complicated and tedious thing to navigate for both individuals and businesses.

Personal Income Tax (PIT) is what we pay as wage earners while businesses pay Corporate Income Tax (CIT).

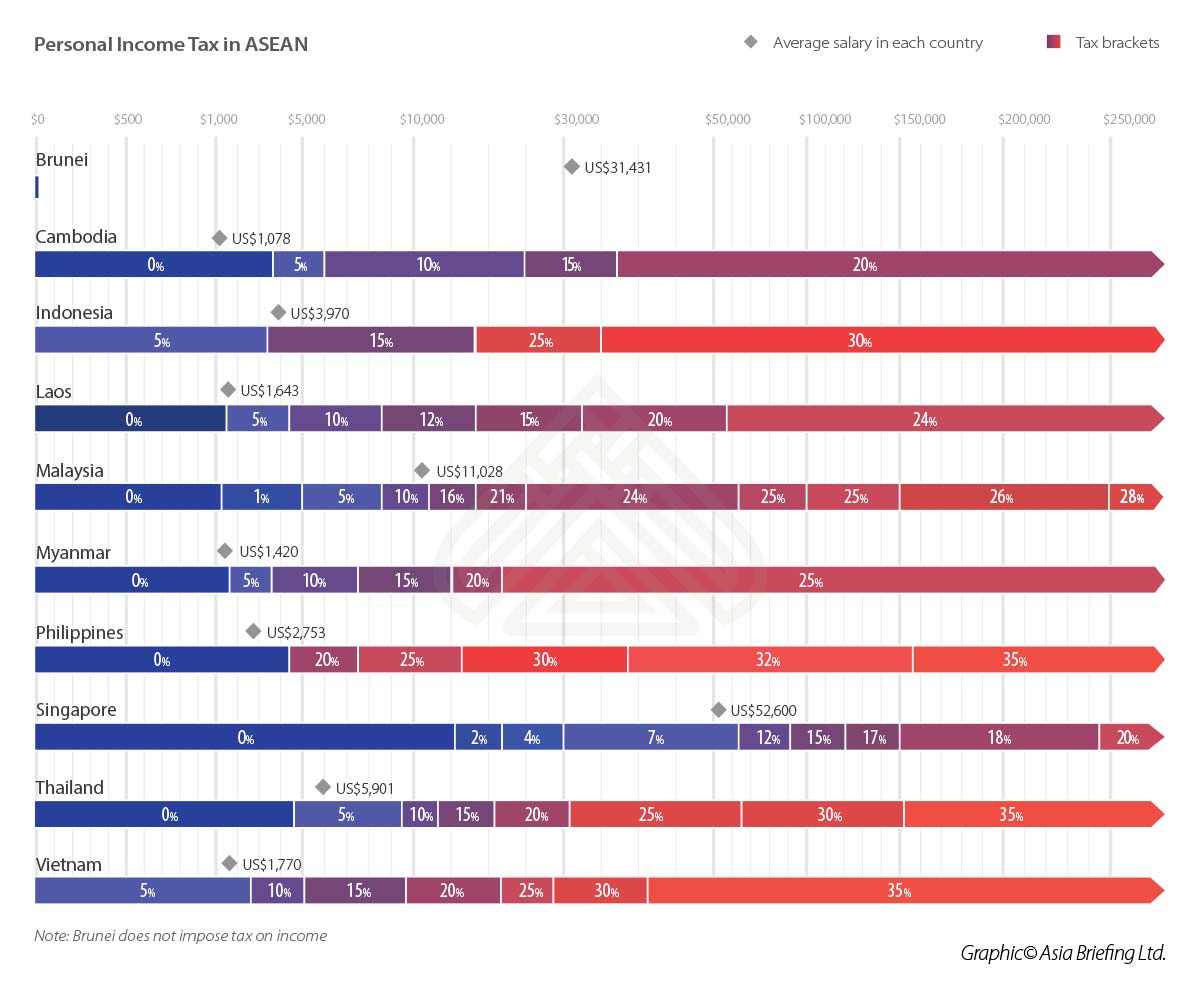

All countries in South East Asia employ a progressive tax structure with most imposing a zero percent minimum PIT rate, exempting lower levels of income – with the exception of Vietnam and Indonesia, who impose a minimum rate of 5%. Philippines, Thailand and Vietnam have the highest maximum tax rate of 35%.

Aside from Brunei, who does not impose any individual tax, Singapore and Cambodia boast of the lowest rate of a maximum of 20%.

It’s important to note that residency status might affect the tax rate. For example in Malaysia, foreigners working in the country for more than 60 days but less than 182 days are considered ‘non-residents’ and are subject to a flat tax rate of 28%. Those working in the country for less than 60 days are exempt from paying taxes, whereas those working for more than 182 days are considered as ‘tax-resident’ and are subject to the standard rate of the PIT.

Lets take a look at the different PIT rates in South East Asia.

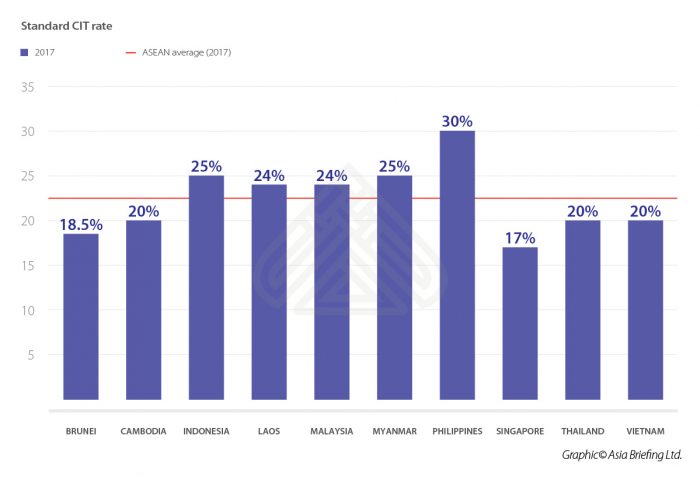

As for Corporate Tax, Philippines imposes the highest tax of 30% while businesses in Singapore enjoy the lowest rate of 17%. In general, the CIT across South East Asia has been on a steady decline over the last decade as countries try to increase their attractiveness to foreign businesses.