What it takes to be CHRO in a private equity-owned portfolio company

- HRM Asia Newsroom

You are a blue-chip CHRO who was recently approached for a role at a private equity-owned portfolio company. On the other side of the table are the portfolio company CEO and CFO looking to recruit a CHRO – their partner in driving the people agenda alongside the strategic and operational agendas. Are you that CHRO? Do you know what it takes to successfully transition from a blue-chip to a PE-owned portfolio company? If you were the CEO and CFO, how would you know you are making the right choice?

What does it take to be a successful CHRO in a PE-owned company?

In this article, we endeavor to answer that question. Informed by our own research and published literature, we present a framework for CHROs to assess their ability to successfully transition into a portfolio company CHRO role and for CEOs and CFOs to gauge CHRO candidates’ ability to make the transition.

Broadening your horizon

Rare is the role that affords CHROs the chance to drive business transformations, test their skills, create future opportunities, and if successful, reap significant financial rewards. That type of role can also be vastly different to the one experienced in a publicly traded business. However, once CHROs get a taste of success in a portfolio company, they not only often want to replicate the experience; opportunity after opportunity can start to arise, launching a new, potentially rewarding career trajectory.

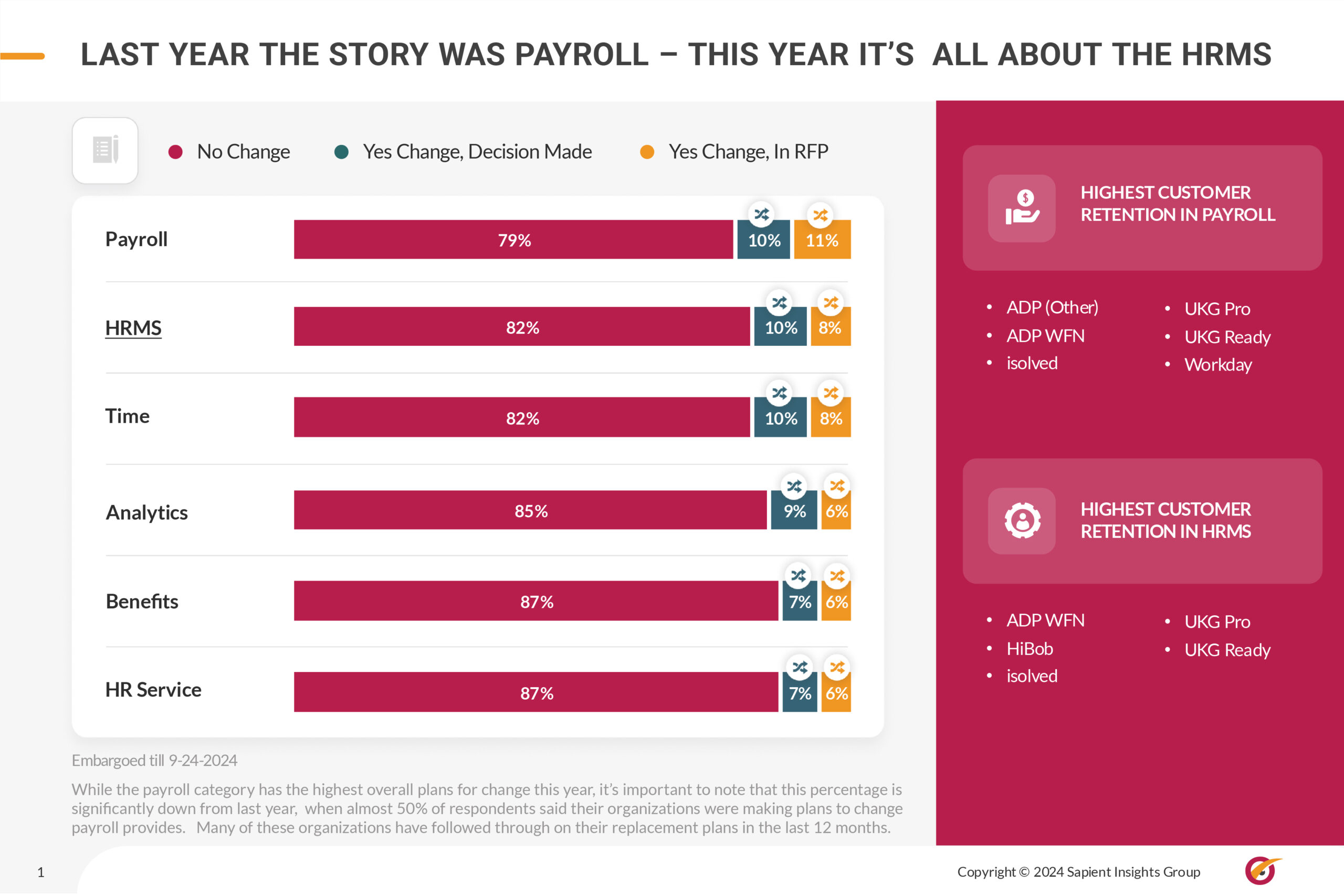

The trend is your friend

Company ownership is changing. In March 1998, 8,000 domestic US companies were publicly listed. Fast forward nearly 20 years: at the end of 2017, this number halved to as little as 4,000.

Initial Public Offerings (IPOs) in the United States have declined since the mid-1980s, decreasing from an average of 300 per year between 1980 and 2000, to an average of 100 per year between 2000 and 2017. Private equity’s net asset value has grown more than sevenfold since 2002, twice as fast as global public net asset values. And consider the growth in US PE-backed companies: they numbered about 4,000 in 2006, rising to about 8,000 – a 106% increase by 2017.

According to research, private equity’s total assets under management trended up nearly sixfold from 2004 to 2019 and is expected to increase another 30 to 40 percent by 2025 to a total of $US8.3 trillion.

Figure 1: Global PE assets under management 2004-2019, and forecast 2025

Experience trumps potential

Portfolio companies seek to attract executive talent with experience operating in public companies with the lure of generating significant value for the PE firms, the individuals managing them, and the executive talent. They are buying experience, not potential – so the CHRO must be prepared to work hard and deliver!

So, are you right for the PE world, and what are the fundamental learnings from HR leaders who have successfully made the switch to PE-backed businesses? Based on our research with CHROs, PE Human Capital Partners, advisors, as well as our personal experience, we believe there are two sets of drivers that the portfolio company CHRO should understand and prepare for if they accept the role:

- The five disciplines for success and,

- The crucial skills and personal attributes

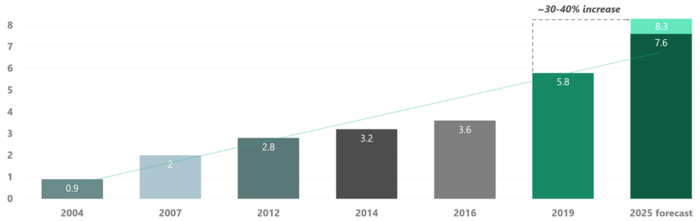

The five disciplines for success

Figure 2 – The five disciplines for successful CHRO transitions from Publicly held companies to Private Equity Portfolio Companies – Rigby-Hall, Butt, 2021.

Assess fast, act faster

The first core discipline – to assess fast and act even faster – is central to the other four disciplines:

- The sponsors’ investment thesis and how your HR strategy will drive that.

- The company DNA.

- The talent.

- Getting work done with fewer resources.

CHROs in blue-chip companies are afforded ample time to set and work toward annual or even multi-year targets, with quarterly and annual reviews, and with the time and opportunity to upskill their workforce. In contrast, CHROs in portfolio companies do not have that luxury, regularly finding themselves in monthly or weekly stand-up meetings. Therefore, as a portfolio company CHRO, you must be quick to assess value drivers and pull key levers even faster. Be prepared to start pulling the levers of the next value driver in parallel with the current levers rather than sequentially.

A recent survey by Alix Partners highlighted the different views on speed – PE executives want portfolio companies to respond faster to changes in the market; whereas portfolio companies want investors to act faster on culture change.

This precept of assessing fast, acting faster is so consequential that it applies to all the other disciplines for success.

“What we are seeing, essentially, is a creative tension between sponsor and operator around speed and accuracy of talent assessment; by acting faster and more skillfully with talent, portco CHRO’s are in a better position than ever to create real value for the investment.” – Ted Bililies, Ph.D., Managing Director of AlixPartners.

Speak the language, use their dialect

Speak finance so that you can quickly assess and understand the economic thesis behind the transaction. Every portfolio company is on a glide path to an event and aligning the HR strategy with that financial event is a must:

- Buy and sell – Quick turnaround of a fit for future leadership team, revamp of the current organisation.

- Buy and hold – Understanding levers for growth.

- Buy and transform – Transforming the business.

Every PE firm and, in many cases, every operating partner, will have a different style; they drive the investment thesis so it is important to understand the impact that this has on the portfolio company culture. A shift has taken place in how operating partners are treating investments today, buy and hold / transform have become more prominent investment theses over buy and sell.

As Environmental, Social and Governance (ESG) measures seem set to shift from non-GAAP to GAAP reporting in the future, they become increasingly important to a company’s valuation growth. In a recent survey 83% of C-suite leaders and investment professionals indicate that they would be willing to pay about a 10% median premium to acquire a company with a positive record for ESG issues over one with a negative record.

Act fast with the CFO to understand the finances short and medium term. With debt fuelling investments, some PE firms emphasise cash flow in a far more demanding way than you may be used to – “cash is king”. And while mastering the financial communication will take you far, you also have to “speak the dialect;” can you explain the difference between ‘Multiple on Invested Capital’ and ‘Modified Internal Rate of Return’?

Getting to grips quickly with the fixed and variable costs of the business and the HR function will support a strong relationship with the CFO. The total wage bill can range from 30% to 60% of a company’s revenue, so you will find focus on this cash-draining cost to be significantly higher at portfolio companies that operate a buy-and-sell thesis to quickly increase the company’s valuation.

Along with defining capital management strategies that drive profitability PE requires HR leadership to be an active participant in all aspects of the business. CHROs who are not interested in the ROI of their strategy and involvement in all aspects of the business, may not enjoy the PE space.

“It’s absolutely essential to understand the PE firm’s needs; for example, an IPO exit requires more capability & culture building than a straight “cut-costs, fix and sell.” – Andy Kaslow, ex-CHRO Cerberus Capital.

Sequence the DNA

Understanding the DNA of the organisation and how it makes money is a prerequisite to leading transformation, often in partnership with the CEO or CFO. A transformation requires fundamental changes in the company culture, management processes, technology, and talent. Leadership has a 10% to 15% impact on financial performance and a 25% to 30% impact on market valuation. 69% of both PE & portfolio executives identified human capital as the top priority for generating value during times of disruption.

Given that the average hold period for a PE investment is 5 years, it is critical to assess human capital opportunities fast, and to act faster. Several PE firms now have Human Capital or Talent Partners who bring data-driven rigor to the acquisition, assessment and development of leadership, and the organisational practices. If such a HC/Talent Partner exists, then they may be a significant resource for additional advice and access to outside expertise.

Now, more than ever before, you need to demonstrate how HR strategy shapes and drives a culture that is aligned specifically to the sponsors’ investment thesis, especially in how you are buying, incentivising and motivating people. 79% of PE leaders feel that employees have increased in importance as stakeholders because of the 2020 disruptions.

Buy the right talent

Many portfolio companies are in a state of flux when the CHRO joins. This means the CHRO must quickly assess and upgrade their function while assessing and acting fast on upgrading management talent and specific value-driving roles deeper in the organisation.

That includes helping leaders figure out who can lead and on what basis, aggressively weeding out low performers, and removing low-value headcount without impacting the business. The time it takes to turn a company around is often a function of the ability to upgrade talent, leadership, and capability. Remember, this is not just about the right team for the current organisation but more importantly, about building the team capable of delivering the future.

“With the need to act fast the focus must be on better aligning talent with value creation by using a systematic approach to identify those roles that have a disproportionately large impact on the company’s value.” – Hein Knaapen, Managing Partner, ceo.works.

Do not underestimate the impact of hiring and building the right team, whilst developing and implementing the right incentive and equity compensation strategy to retain the best talent.

Do less and more, do more with less

And finally…. focus…. quickly assess the smallest number of highest impact changes and act fast on those with laser focus. Do not be surprised if you find yourself with a smaller HR infrastructure and a zero-based budgeting approach. Be prepared to drive more yourself.

You may also find it harder to sell your HR strategy and resource requests in a portfolio company than you were used to at a publicly traded company. As explained, there is growing focus on the importance of employees as stakeholders but there is still a strong scrutiny of all investments. You now need to do less and more whilst being focused on executing your company’s investment thesis.

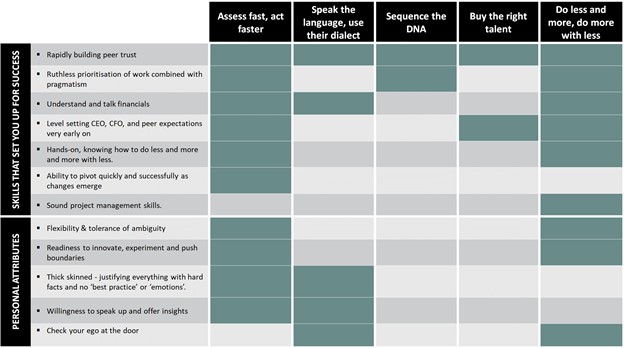

The critical skills and personal attributes

So, what skills and attributes made CHRO’s transitioning to portfolio companies most successful? And how do these skills and attributes interface with the five disciplines of success?

Skills

- Rapidly building peer trust.

- Ruthless prioritisation of work combined with pragmatism.

- Understand and talk financials.

- Level setting CEO, CFO and peer expectations very early on.

- Hands-on, knowing how to do less and more and more with less.

- Ability to pivot quickly and successfully as changes emerge.

- Sound project management skills.

Personal attributes

- Flexibility & tolerance of ambiguity.

- Readiness to innovate, experiment and push boundaries.

- Thick skinned – justifying everything with hard facts and no ‘best practice’ or ‘emotion’.

- Willingness to speak up and offer insights.

- Check your ego at the door!

Figure 3 – Skills impact & attributes required across the five disciplines of success – Rigby-Hall, Butt, 2021

Skills that set you up for success

Per our research: the faster you can build peer trust, the more you will be able to influence and accomplish across all five disciplines of success. Your new team is small and tight knit; trust is the ultimate currency.

Understanding and talking financials, will help in your assessment of how HR can have a higher valuation impact against a lower cost.

Being able to ruthlessly prioritise work, pragmatically, will help you do more with less. Moreover, it will help you understand the company DNA and how to best align and prioritise your HR strategy toward the investment thesis.

You must pivot as quickly as changes emerge so you can re-assess fast. The faster you can level / set expectations with CEO, CFO, and your peers, the sooner you will understand what talent you need to buy.

You will have to execute quickly on all fronts whilst doing less and more, and more with less; you will have to focus on those levers that provide the largest impact whilst delivering more impact with less resources. We have been told recurringly you must be hands-on. Strong project management skills are thus a necessity not a luxury.

Personal attributes required

A major difference with your blue-chip CHRO role is that working in a portfolio company requires you to constantly be ready to assess fast and act faster. The execution act that follows is seldom resourced well, so you need to be willing to check your ego at the door, be tolerant of ambiguity and ready and eager to innovate, experiment and push boundaries yourself.

Big company ‘best practices’ will not help you on this playing field; remember, you have been bought precisely for your experience – so be ready to speak up and offer insights. Creating buy-in is key to executing your plan, be ready to justify directional decisions with hard facts, forget the ego and emotions.

Conclusion

An increasing number of opportunities at PE portfolio companies offer CHROs the potential to broaden their experience in addition to their blue-chip career path.

There has been growing recognition by PE firms and Operating Partners that talent and culture have a significant impact on business performance and help shorten the value creation cycle. An effective modern CHRO can deliver both organisational engagement and financial results.

CHROs can leverage this trend to their benefit by focusing on the five disciplines for success and leveraging the skills and personal attributes outlined in this article to create value through HR in portfolio companies.

Robert Rigby-Hall is Co-CEO of Woosh5 and has over 30 years of global experience specialising in HR and general management. Ommar Butt is a global HR professional with over 15 years of HR experience and a nomadic mindset.