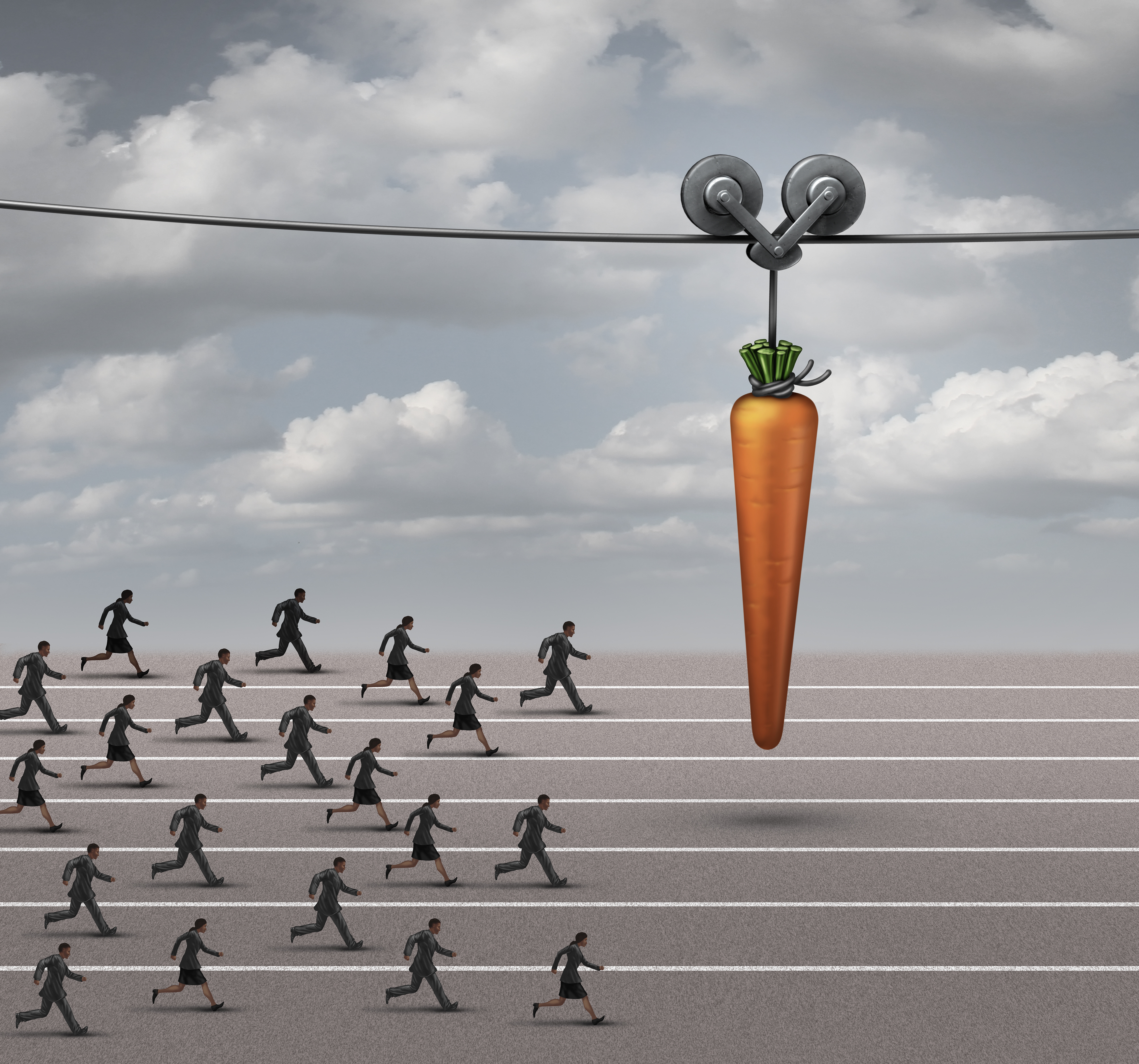

Hedge funds need to dangle bigger carrots to poach talent

- Justin Harper

There is a growing list of sectors that are facing a talent crunch, as they grow quicker than they can find employees.

For example, technology skills are in hot demand, which is proving a headache for any company going through a digital transformation. Added to this list are hedge funds, which are facing their own skills shortage.

Big hedge funds are expanding quickly in Asia, compared to the U.S and Europe, but this growth is under threat if they can’t find suitable candidates. In response, hedge funds are plumping up compensation packages for star performers while committing more resources to younger employees.

Some hedge funds and asset managers are also investing in extensive training programmes, to develop their new hires into portfolio managers. The problem they face isn’t finding portfolio managers, but ones that have experience of investing in Asia while being based in Asia.

The region now has at least eight major hedge fund platforms – twice as many as in 2013 – that oversee a combined US$100 billion globally, according to Bloomberg. While the global hedge fund industry faced a rocky few years as investors rebelled against high fees and poor returns, Asia has been a bright spot due to stronger economic growth and expanding capital markets.