ISCA advances the digital transformation journey in Singapore

- Shawn Liew

With the pandemic having accelerated the digital transformation, many organisations in Singapore have had to adapt existing business practices to new digital solutions. They are also pursuing digital transformation to innovate rapidly, unlock new levels of revenue growth, reduce costs across the organisation, and increase productivity.

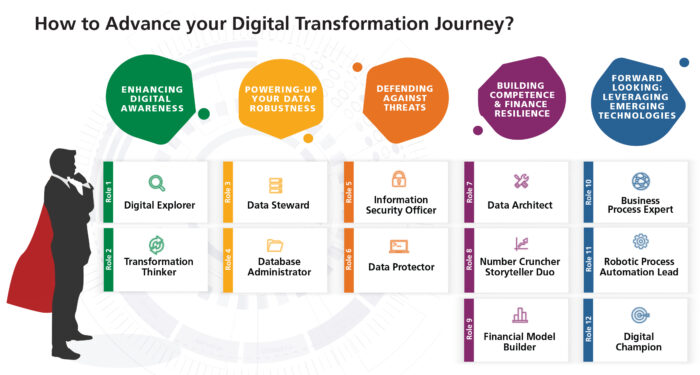

To allow organisations to advance their digital transformation journey more effectively, the Institute of Singapore Chartered Accountants (ISCA) suggests five key areas in its Digital Learning Guide to pay attention to and has identified possible roles for employees – including accounting and finance professionals – in these key areas of the digital transformation journey, as follows:

1. Enhancing digital awareness: Be aware of the digital and cyber trends and concepts and consider their impact on your organisation’s finance functions.

A digital explorer stays updated on cyber and digital trends and discovers how to tap on various technologies.

A transformation thinker stays ahead of cyber trends and understands the concepts to be prepared for future needs.

2. Powering up your data robustness: Organised and useful data is an essential part of effective data analytics for business use. This involves enhancing the robustness of the organisation’s data as an important phase of digital transformation.

A data steward takes care of data governance by ensuring the quality and accuracy of data to support operations.

A database administrator supports the monitoring and management of databases to derive efficiencies in data migration.

3. Defending against threats: With greater reliance on technology, organisations need to beware of incoming cyber threats by gearing up to defend against data breaches and other cyber hazards.

An information security officer supports the shaping of overall security and risk management of cyber threats and data breaches.

A data protector takes on the role of data protection officer in the organisation, ensuring compliance with Singapore’s Personal Data Protection Act (PDPA).

4. Building competence and finance resilience: Explore other areas of digitalisation to build finance’s competencies in using technology. Gain competitive advantage with modelling and data analytics to enrich business insights and strategies.

A data architect employs data analytics to transform data pieces into business insights and strategies

A number cruncher storyteller is effective in reporting, communicating financial updates and insights with data visualisation and storytelling.

A financial model builder creates hypothetical scenarios and apply multiple assumptions to support decision-making of capital decisions.

5. Look forward by leveraging emerging technologies: Be bold and forward-thinking. Advance and leverage new and emerging technologies to level up your organisation’s finance functions and productivity.

A business process expert is familiar with current business processes and is tasked to rethink and simplify processes using relevant technologies.

A robotic process automation lead spearheads the automation of processes for productivity and agility.

A digital champion is digitally savvy, lead digital initiatives and help other executives to buy into the culture change.

ISCA’s Digital Learning Guide identifies 5 key areas and 12 possible roles to pay attention to when making the digital transformation journey.

Optimise training dollars with CPE corporate packages

To allow organisations to upskill and empower their finance team’s effectiveness for the future global economy, ISCA is now offering its CPE Corporate Package, which spans across 450 topics – ranging from e-learning courses, face-to-face classes, and live webinars – to support finance teams in meeting their individual training needs.

These CPE Corporate Package covers digital courses including, Artificial Intelligence (AI) and the Accountant, Digital Transformation and Innovation, Exploring Excel Features for Efficient Data Analysis and Reporting, Financial Data Management with Pivot Tables, Cybersecurity Literacy, Evolution of Risk Management, Building Business Performance with Business Analytics, Digital Transformation using Power BI, Problem Solving with Machine Learning, Artificial Intelligence, Machine Learning, and Robotic Process Automation, and many more.

To accommodate the work schedule of professionals with different peak periods, courses are conducted year-round with more than 1,000 sessions offering delivery options to cater to different learning needs and engagement levels.

Three corporate packages are available for organisations to choose from and ISCA offers a complimentary training analysis for finance teams and will recommend topics that fit specific organisational needs.

Click here for more information on the CPE Corporate Packages. Consider how you can be cost-effective to enhance your employees’ effectiveness in embarking on and making a successful digital transformation.