Forget about purpose-driven organisations – it’s all about the money!

By Laurence Smith, Chartered Fellow CIPD, and a thought leader in digital mindset and transformation. He is also author of the new book ‘Transformation Mindset’.

Last week, my first book ‘Transformation Mindset’ became the #1 global bestseller in both Organisational Change and Business Technology Innovation, as well as #5 in Human Resources.

The book is all about turning crisis into opportunity and looking at how the best leaders and organisations are rapidly evolving, adapting, and transforming in this period of accelerated creative destruction. The first chapter explores the importance of having – or rapidly developing – a real sense of purpose in the organisation, and I claimed this was the starting point and most important thing.

But in the last week or so, as I have been talking to hundreds of leaders around the world, I realised that I had forgotten something even more fundamental – and something that organisations worldwide are beginning to wake up to.

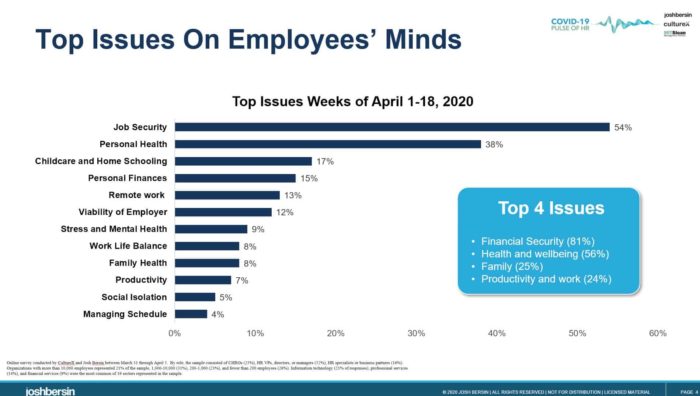

Josh Bersin highlighted it in his recent blog post, COVID-19 May Be The Best Thing That Ever Happened To Employee Engagement, where he started with, “First, companies are protecting workers. It’s clear from our data that the #1 thing on the minds of most employees today is personal financial security.”

Image Credit: Josh Bersin

This is also reinforced by a multi-country study by Qualtrics that shows that the only concern above ‘Financial Pressure’, was catching Covid-19 itself.

The PwC Annual Employee Wellness Study 2020 also shows that ‘Financial or Money matters/Challenges’ is by far the greatest concern. And we all know that the next three areas of concern – jobs, relationships, health – are all greatly affected by financial issues.

What are the implications?

How well are people positioned to cope with this greatly enhanced level of anxiety and stress about financial matters driven by Covid-19 and the accompanying uncertainty?

Not very well, according to data. The majority of Americans have less than US$1,000 saved for emergencies. More than 30% of the participants in a Charles Schwab assessment said they do not have a written financial plan because they think it is too complicated or they do not have enough time to work on one.

More than 20% of the people polled by the National Financial Educators Council said they do not have anyone to turn to for trusted financial guidance.

In the UK, only 23% of employees are on track to be able to retire with the necessary financial resources, only 13% even have a written plan for retirement and even more disturbingly, only 24% even understood compounding interest, inflation, and risk diversification.’

So, employees are telling us that financial matters are their greatest cause of concern, and the data shows that there is generally a very low level of financial literacy in our workplaces.

The moment of realisation

For me this was like a light bulb going off. If people are fundamentally afraid that they will not be able to pay the mortgage, buy groceries, and send their kids to school – are we missing something?

I would argue yes, absolutely. While we are doing many of the right things well, there is just one more thing we need to do, and we need to do it now. This is not a ‘nice to have’ to consider when we are out of crisis – it is the single most vital thing we must add to our strategy right now.

My moment of realisation – dare I say enlightenment – was when an old friend and colleague showed me what he was working on now. My immediate reaction was, “Oh my gosh – I wish I’d had this 20 years ago – my life would be very different today!”

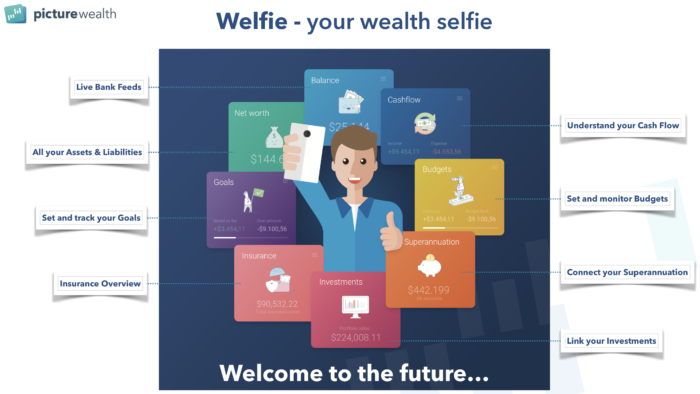

They say a picture is worth a thousand words – well, this picture was worth a million dollars to me.

An integrated view of my entire financial well-being in a single picture – what they call a ‘Welfie’ – meaning ‘Wealth Selfie.’ This is a simple to use financial wellness and wealth management solution that allows you to see your entire financial situation in a single picture, to track it in real time, and to use it to plan.

For me, there were three things about this that are totally different from every other ‘financial planning’ and ‘wealth management’ solutions I had seen before:

- A single, graphical, fun, easy-to-understand view of my entire financial situation.

- It is global and comprehensive so I can pull in every single bank account, investment, insurance policy, budget and see all my savings, spendings and investments in a single place.

- It is AI-enabled.

And that last point matters. The best of the so-called ‘Robo Advisers’ already perform as well as the average human adviser – but in all fields we are seeing that it is when humans are ‘augmented’ by AI that we get optimum performance.

Multiplying Maslow

I think we need to add to our Covid-19 response strategy and our employee engagement and experience strategy going forward – a strategy for financial wellness, and we need to do it now.

Let me propose a new way to think about this and you will realise why I believe that financial literacy and wellness has to be the next big trend in employee engagement and experience.

We all know about Maslow’s hierarchy of needs, and how a sense of self-actualisation sits at the top, and some people have cheekily added wifi and battery life to the bottom as ‘must-haves.’

But I now believe that this pyramid sits within an even more vital (all encompassing) sphere of influence – what I am for the time being calling the ‘sustaining force’ of financial wellness.

I have come to the realisation that unless we address financial wellness, the whole pyramid of Maslow’s hierarchy of needs is on shaky ground. It needs not just a firm foundation of financial security to reduce stress and anxiety – but a comprehensive financial literacy and wellness programme that will multiply the impact and effectiveness of all the other factors on the pyramid.

In fact, I am increasingly convinced that financial wellness is the next multiplier of organisational fitness and adaptability, employee engagement and experience, as well as productivity and retention.

I would argue that one of the most critical things leadership can do to improve productivity and efficiency, retain key staff and reduce unwanted attrition costs while simultaneously helping employees through this crisis, is to immediately focus on financial wellness.

We need to help employees not just weather this storm, but to emerge from this crisis better positioned for success moving forward. We think too narrowly of success within the confines of work and career, but we need to care for our whole employees, and their ability to live their purpose not just at work, but with their family and in life as a whole.

What are we waiting for?

All the established thought leaders are, quite correctly, talking about the importance of a renewed focus on leadership empathy and resilience – but few are talking about financial resilience and the ability to be able to support your family. In fact, few companies care enough to even educate their employees to a basic level of financial literacy.

There is a massive opportunity here for companies to step forward and help their employees get smarter and make better decisions about their financial health and wellness. I believe this is the new multiplier of employee engagement, productivity and commitment.

Laurence Smith is the author of the new book, “Transformation Mindset: 10 Things Leaders should be Doing Today to turn Crisis into Opportunity”, which is now available.